What do we call that crucial piece of paper that serves as a record of an employee’s wages, taxes, and deductions? Yes, right, that’s termed as a pay stub. This term is quite popular In the realm of employment and financial documentation. This document, which frequently comes with a paycheck, thoroughly explains how an employee’s earnings were determined. It’s crucial for both employees and employers to understand what makes up a pay stub in order to preserve accuracy in compensation and compliance with labour laws.

We’ll examine the essential components of a pay stub in this blog and explain why it’s important to understand what it contains.

1. What Is A Pay Stub?

A pay slip includes several words that fundamentally relate to the same document and are frequently used interchangeably, including paycheque stub, payslip, and salary slip. The most basic definition of a pay stub is that it is a receipt provided by your employer that contains crucial information about your wages. This comprises information on your overall gross income, relevant deductions, taxes withheld, and finally, your net income, or how much money you keep after all necessary financial adjustments. A pay stub essentially provides a visible breakdown of how your earnings are distributed and makes it easier to have a thorough grasp of your remuneration by capturing a snapshot of your financial activities over the course of a particular pay period.

This is the document you get from your employer when you’re paid for your job. It’s like a detailed receipt that explains how much money you earned and what happened to that money. It shows your earnings before any deductions, like taxes or insurance, were taken out. Then, it lists all the deductions and payments that were subtracted from your earnings, and finally, it gives you the actual amount of money you get to take home, which is called “net pay.” The pay stub also includes important information, like your name, the dates for the time you worked, and a summary of your earnings and deductions for the year so far. This document helps you understand exactly how your pay is calculated and where your money is going.

2. Example Of Pay Stub

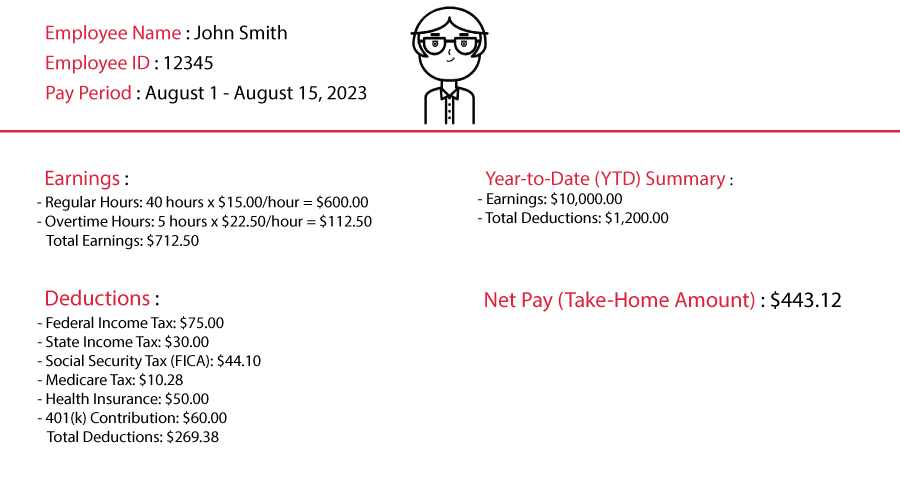

Let us understand this example to get a better understanding.

In this example, John Smith worked 40 regular hours and 5 overtime hours during the pay period from August 1st to August 15th, 2023. His regular hourly wage is $15.00, and his overtime rate is $22.50. His total earnings before deductions are $712.50.

The deductions section lists various deductions, including taxes (federal and state), Social Security tax, Medicare tax, health insurance, and a contribution to his 401(k) retirement account. The total deductions amount to $269.38.

After subtracting the deductions from his total earnings, John’s net pay (take-home amount) for this pay period is $443.12.

The Year-to-Date (YTD) summary provides a snapshot of John’s earnings and deductions for the entire year up to this point. It shows that he has earned $10,000.00 in total and had $1,200.00 in deductions.

3. Key Elements Of Pay Stub

There are certain elements that every pay stub includes as a basis element. Here are some of them that are typically present on pay stubs:

- Employee Information: This section contains the name, address, and occasionally the employee’s employment ID or Social Security number. It aids in determining whose pay stub it is.

- Earnings: The employee’s earnings for the pay period are broken down in this section. It consists of base pay, overtime pay, commissions, and bonuses. It displays the employee’s gross pay, excluding any deductions.

- Deductions: Deductions are different amounts deducted from an employee’s pay, such as account contributions, health insurance premiums, and other benefits. To determine the net pay, these deductions are removed from the gross income.

- Net Pay: The sum that remains after all deductions have been made from an employee’s salary is known as net pay. It is the precise sum that they get paid into their bank account.

- Pay Period: The dates of the precise pay period covered by the paycheck are listed in this section. Employees benefit from knowing which work time the payment relates to.

- Gross Pay: Before any deductions, an employee’s gross pay is the sum of their earnings. It serves as the basis for figuring out the net pay.

- Hours Worked: The pay stub for hourly workers may include the total number of hours worked during the pay period, which is used to determine earnings.

- Pay Rate: The pay rate describes the employee’s hourly wage or salary rate.

- Payment Method: It details the employee’s preferred form of payment, such as local payment methods, direct deposit, cheque, or another option.

- Employee Benefits: This section may include information on additional perks provided to the employee, such as accrued vacation time or sick days.

- Company Information: The name, address, and contact information of the employer or company may be included on the pay stub.

4. Importance Of Pay Stub

Pay stubs are very important for both employees and companies since they are crucial records that support financial accountability, transparency, and compliance. Pay stubs provide employees with a thorough and clear account of their earnings, deductions, and overall compensation. They make it apparent how much is being made, how taxes and other deductions are calculated, and how much will be left over for the employee’s take-home pay. Employees are given the tools they need to manage their money well, set aside money for savings, and make investment plans. Pay stubs are also essential during tax season because they provide the data required to correctly file income taxes and guarantee adherence to tax laws.

Pay stubs are essential tools for a company to use in order to maintain honest and legal payroll procedures. Employers build credibility and trust by giving employees pay stubs, demonstrating their dedication to precise and fair payments. Pay stubs also make it easier to maintain precise records and paperwork, which is crucial in the event of audits, legal inquiries, or disagreements. Pay stubs also assist firms in adhering to labour rules and regulations as they serve as documentation of accurate wage computations, tax deductions, and benefit contributions. In general, pay stubs are a crucial component of efficient payroll administration, fostering a positive employer-employee relationship, legal compliance, and shared financial responsibility for all parties.

5. What Are Pay Stubs Used For?

Pay stubs are useful for both businesses and employees in many different ways. The following are some major applications for pay stubs:

Proof Of Income: It serves as documentation of an individual’s income, which is frequently needed for a variety of financial transactions like loans, mortgages, credit cards, or rental agreement applications. Pay stubs are used by lenders and landlords to confirm an applicant’s capacity for repayment.

Tax Documentation: Pay stubs provide details regarding taxes deducted from an employee’s wages. To file taxes correctly, you must have this information. Pay stubs are used by individuals to declare income, make deduction claims, and make sure they are in conformity with tax laws.

Budgeting & Financial Planning: Pay stubs give employees a better understanding of their genuine income and how much money they can anticipate having after deductions by providing information on gross and net earnings as well as deductions. This knowledge is essential for developing a budget, controlling spending, and establishing financial objectives.

Dispute Resolution: Salary stubs can be used as proof to settle disagreements with employers if there are any anomalies regarding salary or deductions. These records provide an accurate accounting of earnings and expenses and can be used to check for inconsistencies.

Employee Verification: It may be required by employers when checking an employee’s job history, remuneration information, or working hours. For promotions, transfers, or reference checks, this may be crucial.

Year-to-Date Tracking: A year-to-date (YTD) summary of earnings, taxes, and deductions is shown on pay stubs. This data is useful for tracking earnings and deductions over time and assisting people in evaluating their financial development.

Record Keeping: Pay stubs are used by both businesses and employees for precise record-keeping. Pay stubs are kept by both employers and employees for personal financial management and future reference. Employers keep them as part of their financial records and for tax purposes.

6. How to Read and Interpret Your Pay Stub

Understanding your earnings, deductions, and general financial health requires reading and comprehending your pay stub. An accurate breakdown of your earnings and deductions for a particular pay period is provided on a pay stub. Your name, employee ID, and the dates of your pay month are normally included in the top column. Your net pay—the amount you take home after all deductions—and your gross pay—your total earnings before deductions—are the two key factors to concentrate on. These are followed by a detailed list of deductions, which includes federal and state taxes, Social Security and Medicare premiums, as well as any optional deductions like retirement or health insurance premiums. Reviewing these elements in detail can help you develop precision.

Additionally, pay stubs frequently include accrued vacation, sick, or other paid time off information, enabling you to keep track of your benefits. Understanding the year-to-date numbers on your pay stub can also provide you with a wider financial perspective and make it easier for you to track your earnings and deductions over time. Learning how to read and understand your pay stub gives you the power to take charge of your financial planning, budgeting, and decision-making, allowing you to make wise decisions about investing, saving, and efficiently managing your resources.

Best Practices Related To Pay Stub

To promote accurate and open communication about remuneration between companies and employees, best practices for pay stubs are crucial. Here are some essential best practices to take into account:

Proper & Clear Information: Make sure that pay stubs clearly break down all pertinent information, such as gross pay, net pay, deductions, taxes, and any additional earnings or perks. Employees can better understand how their pay is determined and what deductions are made with clear and thorough information.

Compliance with Regulations: Keep abreast of local, state, and federal laws governing the necessity of pay stubs. The specifics of what data, such as taxes, deductions, and benefit accruals, must appear on pay stubs may vary depending on the jurisdiction. Following these rules helps preserve compliance and prevent legal problems.

Consistent Delivery: Whether it’s biweekly, monthly, or in accordance with your company’s pay cycle, provide pay stubs on a regular and predictable schedule. Employee financial planning and confusion are both reduced by consistency.

Digital Accessibility: Provide employees with internet access to their digital pay stubs. This improves the ease and lessens the environmental effect of paper documentation, especially for distant or mobile workers.

Security Measures: Put security measures in place to safeguard private employee data on electronic pay stubs. Unauthorised access and data breaches can be avoided with the aid of encryption, secure login protocols, and access controls.

Final Words

Both employers and employees must comprehend what a pay stub is and its importance. An employee’s earnings and deductions for a particular pay period are broken down in detail on a pay stub, which is an important record. It promotes trust and accountability in the workplace by acting as a transparent record of financial transactions between an employer and an employee.

Employees can learn more about their gross compensation, various deductions (including taxes, insurance premiums, and retirement contributions), and net pay by looking at their pay stubs. People are better able to manage their own money, create effective budgets, and assure the correctness of their remuneration thanks to this information.

In essence, a pay stub is more than simply a piece of paper or a digital record; it is a representation of financial openness, a tool for empowerment, and a pillar of positive employer-employee relations. A thorough grasp of pay stubs is essential for promoting financial well-being and establishing a sense of respect in the modern workplace as people and organisations navigate the constantly changing world of work and finance.